The importance of savings is the first lesson for anyone on the path to financial independence. Whether you currently like the idea of saving a fixed amount of your paycheck or not, it’s time to learn to love it.

The reason is simple: you will not amass a large fortune without starting with a small one. The importance of compound interest, time value of money, and dollar cost averaging are all in your favor when you invest on a regular schedule. Starting early allows your money to work for you longer by giving your interest time to compound and ultimately act as a regular addition to savings.

Dollar cost averaging is covered in depth here, but the short description is buying at regular intervals with the same dollar value. This process lowers your average purchase price. You buy fewer shares when prices are high and more shares when prices are low.

These benefits exist for anyone willing to save a fixed amount of every dollar earned. However, you should not ignore how difficult implementing a savings plan can be, especially for someone not accustomed to saving regularly. Many Americans do not have enough money in their savings accounts to cover a $300 car payment, so asking them to save some of their income is difficult.

This is especially true because saving money doesn’t provide any immediate benefit of consumption or pleasure. If you’d like to start saving, keep reading, because here is a four-step program to savings recovery that can remedy that problem.

Step 1: Set Up Financial Protection Via Your Emergency Fund

To start, you need to identify the savings amount you need and recognize your current state of affairs. You will want to have an end goal of saving 10 percent of your pre-tax income. At first, this will roll into an emergency fund, then you can move this cash flow to investments. It is important to note that paying off loans, while important, is not included in this 10 percent.

A common misconception is to use your 10 percent of income to pay off loans first, then add to your savings and then, finally, to add to your investments. You should use your initial savings to build on your emergency reserves, so you can reap the rewards of short term financial security.

Look Beyond the Six-Month Rule

A good place to determine the size of your emergency fund to use is the six-month rule. The six-month rule states you should have the equivalent of six months-worth of expenses in your emergency fund. However, the definition of expenses is open to interpretation. Does this mean you should match your current level of expenses or the expenses you could cut back to in the event of job loss or illness?

The idea is to focus on a happy medium for your emergency fund calculations, like your main household bills and bills you cannot easily disconnect. Expenses you should not consider as emergency expenses include cable, dining out and entertainment. When you face a financial emergency, you need to cut out the extras, like Netflix and going for beers after work, so you can spend your time focusing on a new income stream while pulling from your emergency stash.

Take your list of trimmed expenses and multiply this number by six. This is your emergency fund goal amount for the average person. However, most of us do not fall in the average of the savings distribution. The size of your emergency fund is more complicated than the six-month rule of thumb. Your risk tolerances, the stability of your job, and the probability of expected cash draws should all come into play.

Weigh Your Risks and Tolerance

If you feel you have a higher probability of expenses in the future, such as a baby on the way, unknown house repairs in an old house or an aging vehicle, you should increase your monthly expense estimation to account for these expenses. The money you spend on diapers or repair bills can add up quick.

If you think there is an increased risk that something may negatively affect your income stream, like expected layoffs at work, adding a month or two onto your six-month emergency fund makes a lot of sense.

Overall, there is no true emergency fund measure that works for everyone. You may be averse to taking risks and prefer a full 12 months of expenses in your savings account. On the other hand, you may not need a large emergency fund. Perhaps you have a stable job or have other financial assets you can sell for quick cash, or you are too busy living the YOLO life. Ultimately, you are saving for your own emergencies, and only you know what savings level makes you feel comfortable.

Regardless of your choice of emergency savings amount, the recommended maximum is one year in savings. This is already a high amount, so saving any more than that could cause you to miss out on investment opportunities that could offer a higher return.

The next step is to identify the order of your savings deposits. For the sake of simplicity, let’s assume you need $20,000 in an emergency fund and you currently make $60,000 per year. In total, you believe you can save $20,000 per year, which is much more than the minimum you should save of 10 percent or $6,000 of your income yearly.

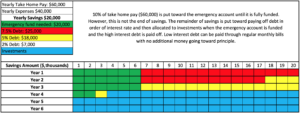

You will put the first $6,000, or 10 percent of your take home pay toward your emergency fund. Use the remainder to pay off loans and fund investments. See the example below to understand the yearly allocation of $20,000:

At the end of your fourth year, you would have completed the initial goal of funding your emergency fund. While on this four-year journey, you should have also paid off your high-interest debt and worked towards stabilizing your expenses.

This is a tough time of savings for most people. Mentally, you may feel as though you’re wasting your money. You not investing it, and instead, it is sitting in savings accounts or paying off debts you owe to someone else. You must fight through these feelings. See this as an accomplishment from many different angles.

Reviewing the previous example, you will see you are not throwing $20,000 of your first year’s salary into savings. The amount is only $6,000. The remaining goes to debt repayment and investments. You should not ignore the benefits of paying yourself first and creating a safety net for yourself and you’re your family. From a psychological standpoint and prudent financial literacy, an emergency account is a powerful asset.

You’ve established the amount of savings you need in your emergency fund and how long it will take to fund the account with a minimum of 10 percent savings. What happens after this is where the magic begins to happen.

Step 2: Fuel Your Investments and Pay Off Debt

After you’ve funded your initial emergency savings, use your savings to fund investments and pay off debt. Just like saving for your emergency fund, you never want to stop paying yourself first. Assuming you make the same $60,000 salary, you will have a minimum of $6,000 every year to put toward financial independence.

If you have high-interest debt to pay off, you should put all savings to debt repayment. The only exception to this is when your employer offers retirement matching. This is an immediate 100 percent return that you should not ignore.

High-interest debt is any debt that, when you pay it off, is a better return on your money than investing your money directly. Any debt with an interest rate of four percent or more is high-interest, so paying off this debt is a high priority. Debt with an interest rate of three to four percent is okay to pay off if you enjoy carrying less debt. From a pure numbers standpoint, it is better to use your money to invest that to pay off debt. From a psychological standpoint, if you prefer to be debt free, pay off as much debt as you like. Just be sure to balance any low-interest rate debt repayments with investments, as well.

When the day comes and you’ve paid off your high-interest debt, you can roll your full savings into investments on a yearly basis. Remember that the 10 percent of your pay is the minimum amount. For early retirement or a speedy path to financial independence, the percentage you should pay yourself should be much higher than 10 percent. In fact, 20 to 30 percent for a gross savings rate is not uncommon in the financial independence and early retirement worlds.

Calculate Your Gross Savings Rate

To calculate your gross savings rate, take the amount you add to your savings or investments and divide it by your pretax income. Doing this on a yearly basis will give you an idea of where your rate lies. It will also provide a good estimation for future years.

It is also common to calculate a net savings rate that includes your savings amount divided by your take-home pay. This gives you an idea of how much of your income you spend versus how much of your income you save on a yearly basis. This is an important aspect of understanding your future financial needs in retirement.

The third savings rate calculation is the savings efficiency ratio, which is similar to a current ratio in financial analysis. All you have to do is divide your savings amount by your total expenses. This is an efficiency measure that takes out the size issues of income. What is nice about this measure is it allows you to track your progress regardless of how much you make.

Reaching financial independence efficiently is easier with today’s technology. Here are some of the automation tools you can use to accomplish your savings goals.

Step 3: Use Automation to Make Saving Easier

A great way to ensure that you will not spend the amount you have set aside for savings is to never have it available. There are great options in with today’s technology that makes this a reality.

When building your emergency fund, the simplest way to ensure growth is through an automatic bank transfer. Most banks have the option to set up an account-to-account transfer on a recurring basis. Calculate your monthly savings amount and have your bank automatically transfer some of your income from your checking to your savings account.

In times of difficult temptation, it is best to set up the transfer every two weeks or on the day of a paycheck. That way the money never sits in your account for more than one day. After you have built your emergency fund, automation becomes slightly more involved. Since you are no longer adding to your savings account, you are adding to an external retirement or investment account.

Decide on the amount you will send to your investments and how much you will need to pay off high-interest debt if . Set your automatic transfer from your checking to your investment account and to your debtors through online bill pay.

If your bank does not allow free outgoing transfers to an external account, then go the opposite way. Go to the bank you use for investments and set up an automatic transfer to this bank from your personal checking account. Many banks naturally allow for free incoming transfers, but some may charge a fee for outgoing ones. Use this to your advantage while continuing to automate your savings process.

If your choice of investment savings is through your job’s retirement plan, you can set up automation by filling out your investment withdrawal agreement at work. Just tell them how much to take out pre-tax from your pay, and where to allocate this money within your investment choices. The nice thing about this option is the money never touches your checking account, so you’ll never miss it.

If you plan to invest outside your company retirement plan, or if your job doesn’t have one available, ask if they allow multiple direct deposits. It is a common practice that employers will allow at least two different deposits for your paycheck.

You will specify the amount or percentage to each bank. Once you have your deposits set up, your bank will direct deposit the set percentage of your paycheck automatically to your investment company and the remainder will go to your checking account. This gives you the benefit of automating your investment savings even without access to an employer’s retirement plan.

Step 4: Start All Over Again

Once you have mastered the automation of savings, the last step of the four-step plan is to reevaluate. This four-step plan could take years, so a lot can change. Expenses could increase or decrease, your savings rate may increase, or you could get a raise. All these things mean that you should evaluate your savings plan and automation procedures regularly.

Re-evaluate at least once every six months or after a major financial event, such as when you have finished funding your emergency fund, you pay off a loan or get a pay increase. Ask yourself questions like:

- Has your timeline changed?

- Do you need to increase your automated savings amounts?

As you can see, this is more than a four-step path to savings. It’s the start of a mindset that prepares and trains you for efficient financial independence. Take this information and use it to build a strong foundation for the financial future of yourself and your family.