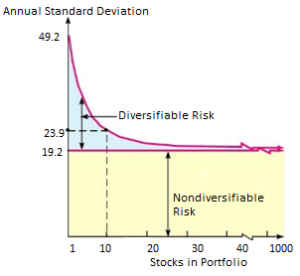

Investing in individual stocks or beating the market comes up regularly in conversations with friends, family, and students. The excitement of buying stock in the next big thing and beating the market by earning 1000% percent returns is a dream for anyone who has ever bought stocks. The concern with this dream is whether it […]

Avoiding Affiliate Site Scams

When researching something to purchase, a typical search technique is to Google the best of these items. Maybe it’s the best camera or the best backpack. Search terms like these will provide you with a plethora of pages devoted to “Best cameras of 2017”, “Best backpacks under $200”, etc. On the forefront, this is great; […]

The Trap of 0% Financing

We have all heard the zero percent financing cry for attention. “Buy this new car and get zero percent financing”. “Need a new TV? No problem! Finance with zero percent and no payments for six months.” These offers sound great. Why spend money now if I can borrow the cash at zero percent. The stock […]

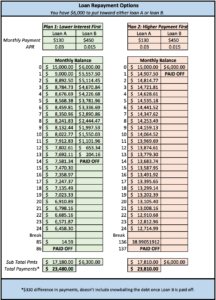

Paying Off Loans to Increase Cash Flow

Paying off debt with the highest interest rate first, then moving down the line to lower interest rates is common advice in the finance world. There is no question this plan will save you money in interest payments from a purely numeric standpoint. I even discuss this strategy in my cash windfall article. However, like […]

There’s a Recession Coming! Right?

Most people have heard the ominous lines of professionals, the media and even those who know nothing about the market issue the following warning: “The market has been up for so long, the next drop is right around the corner.” They will advise by saying, “It’s time to sell; we are due for a recession.” […]

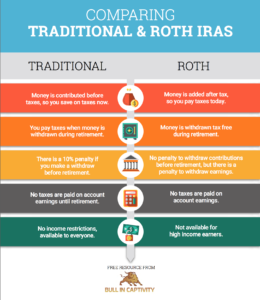

Quick Comparison of Traditional and Roth IRAs

Traditional IRA Money is contributed before taxes, so you save on taxes now. You pay taxes when money is withdrawn during retirement. There is a 10% penalty if you make a withdraw before retirement. No taxes are paid on account earnings until retirement. No income restrictions, available to everyone. However, tax deduction is limited by […]