Investing in individual stocks or beating the market comes up regularly in conversations with friends, family, and students. The excitement of buying stock in the next big thing and beating the market by earning 1000% percent returns is a dream for anyone who has ever bought stocks. The concern with this dream is whether it is possible to pick the will be winners and avoid the losers. Even more important is ensuring that the portfolio of winners you create does not have more risk than the market itself.

The Efficient Market Hypothesis

The market efficiency field of research focuses on these two areas: risk and return. The basic premise of the Efficient Market Hypothesis is that the market correctly prices stocks. There are many people all over the world all looking at the same stocks. They read the annual reports and the management announcements, they listen to earnings calls and have news alerts set to alert them each time the company shows up in the news.

When this many people are buying and selling the same asset, the odds of the market price being wrong are very slim. The Efficient Market Hypothesis says that the market is not wrong at all. The second new information is available to these market participants, the price changes to reflect the impact of this new information.

So what does this mean for the average investor? It means that prices are always correct and there is no such thing as mispricing. It is impossible to buy a stock that is undervalued or trading at a price lower than what it should be trading. The market always prices stocks correctly. An investor cannot research Company A and determine that the price of the stock should be $80 when it is trading at $50 and make a $30 risk-free return.

The ideas behind the Efficient Market Hypothesis does not mean that an investor cannot make a positive return in the market. On the contrary, an investor can earn large returns in an efficient market, but these returns are not earned without risk. In the above example, the investor who buys an undervalued stock of Company A takes no risk. He is aware that the stock is underpriced by $30 and will make this return without taking any risk.

An investor can invest all of his money in a portfolio of risky penny stocks and earn millions of dollars and 5000% returns, but the Efficient Market Hypothesis would still hold because the risk assumed for this investment matched the high returns. To summarize the Efficient Market Hypothesis: An investor cannot earn a return without an appropriate amount of risk. A return without risk would be an abnormal return, and this is nonexistent in an efficient market.

Beating the Market

An idea closely related to the market efficiency is attempting to beat the market, or earn alpha. Mutual fund managers are paid to create alpha for investors. To beat the market means that an investor has succeeded on two levels: a higher return and equal or less risk than the market. The second component is regularly forgotten.

I hear people brag that they picked three stocks at the beginning of the year and they have successfully beat the market. Sure, they have earned a return higher than the market return, but what happens when we scale by risk? The risk an investor takes by investing in a small number of stocks is very high. Because of this, when these substantial returns are scaled by much higher risk than the market, it is easy to see that the investor did not beat the market.

A ratio used to test this reward to risk ratio is the Sharpe Ratio:

Portfolio Return – Risk-Free Rate / Standard Deviation of the Portfolio

In the numerator, the risk-free rate is taken out of the portfolio return because the focus is on the risky component of the portfolio return. The standard deviation of the portfolio is a measure of portfolio risk.

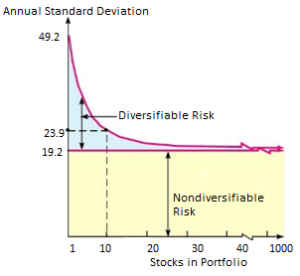

Two Types of Risk

To reduce risk, an investor can diversify the portfolio by including non-correlated stocks. Owning all technology stocks puts an investor at risk for a technology crash. But, by owning some tech, some banks, some construction, etc. the investor can weather a storm that hits only one industry. This risk is diversifiable risk, meaning that is can be diversified away by adding more stocks. Any risk that is company or industry-specific is diversified. However, no matter how many companies are in a portfolio, there will always be some level of risk, known as non-diversifiable risk. These are risks that affect all stocks such as interest rates, GDP, and unemployment.

Levels of Market Efficiency

An efficient market is a large pill to take for many people. It’s hard to believe that the market is correct at all times for every stock. Due to this concern, market efficiency can be broken down into three levels from the most efficient to least efficient.

Strong Form Efficiency– In a strong form efficient market, the market prices everything perfectly. It is efficient in its highest ability. All information including pricing information (charts), public information (fundamentals, annual reports, news), and private information (insider trading) are included in the stock price. No matter which of the aforementioned information an investor has, he will be unable to earn an abnormal return, or a reward for a lower amount of risk.

Most people would not agree with this level of efficiency because finance researchers have shown evidence of insider trading where insiders can earn a return without taking any risk because they knew something the public did not. In these cases, stocks were incorrectly priced due to private information.

Semi-Strong Form Efficiency– In this form of efficiency, the market prices include all public information and pricing information, but not private information. This means that if an investor has private information, like tomorrow’s earnings announcement, that is not publically available, then they would be able to earn a return without risk. Any fundamental or publically available information, as well as pricing information, would be included in the price. Meaning that if you researched a company based on public information, you would be unable to earn an abnormal return.

Weak Form Efficiency – The weakest form of efficiency. The market is barely efficient. Market prices include pricing information such as price and volume but do not include any public or private information. If someone believes that they can pick the best stocks with lower risk because of research they have conducted with public information; then they would argue that the market is weak form efficient. If the market had any higher of an efficiency, these abnormal returns would not be possible.

The only area knocked out by all forms of efficiency is technical analysis. Because technical analysis uses price and volume information, all three levels of efficiency state that an investor would be unable to earn an abnormal return with this information.

Research has shown that the market is not strong form efficient. People who believe that they can earn an abnormal return by researching companies will argue that the market is weak form efficient. Those who believe that stock picking is an impossible task will argue that the market is semi-strong form efficient, where public information is already included.

Research conducted in finance on the ability to pick stocks shows that investors cannot choose the winners and ignore the losers. Even if the stocks are picked correctly, the risk taken will cancel out these high returns. This has lead to the creation and importance of index funds. Instead of trying to beat the market, owning index funds makes owning the market easy. If you can’t beat the market, buy the market.