Everyone hopes to encounter some sort of cash windfall in their lifetime. Whether it is an inheritance, the sale of a business, a bonus at work, winning the lottery or the happenstance of stumbling upon a briefcase of cash, it is important to know what to do with such a windfall. Most people wonder about the process they should use to invest their sudden wealth. If you happen to be lucky enough to be holding on to a cash windfall, read on to learn how to handle it properly.

Before You Invest: Important Things to Look at First

There are two camps when it comes to windfall investing: dollar cost averaging and lump sum investing. Upon receiving a lump sum of cash, you should follow a specific order of distribution before deciding on an investment strategy. If you have any debt or do not have an emergency fund then you should read this article on . The short version of this plan is to take your cash and put it toward an emergency savings fund.

If you already have an adequate emergency fund set up, you should plan to put the cash toward investments and debt. If your employer matches your retirement contributions, then add to retirement first. If your employer doesn’t offer matching, pay off any high interest debt. This means anything with a four percent interest rate or higher.

Once you have looked at your emergency fund, paid off any high-interest debt, you should put all your remaining cash toward retirement and investments. If this process seems confusing, don’t worry, because you will learn how to go about investing this last amount of cash.

Reduce Your Risk: All About Dollar Cost Averaging

When receiving a large amount of cash, most financial experts recommend you spread out the purchases for the benefit of dollar cost averaging. Dollar cost averaging reduces the risk of market timing, which is when you try to pick the right time to buy a particular stock, by eliminating the possibility of buying at the high point of the market.

To start a dollar cost averaging process, you can purchase stocks on a regular schedule with a set amount of money. Here are two critical pieces of investing advice:

- Buy regularly, not according to market timing.

- Focus on the dollar amount you use to purchase stock, not the number of shares you purchase.

Here is an example that explains why you should purchase stock based on a dollar amount and not the share amount:

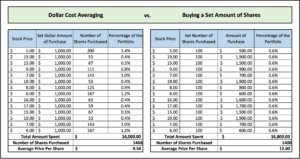

In this example, there are two situations: Buying a set dollar amount or purchasing a set nominal number of shares. After randomly generating some stock prices, you can see that the dollar cost averaging strategy is beneficial in multiple ways.

With dollar cost averaging, you can purchase a smaller number of shares when stock prices are high, and when stock prices are low, you can buy a larger number of shares. This is a win-win situation. You buy more low-priced stocks and less high-priced stocks. Over time, your average stock price drops because of this simple strategy.

On the contrary, when buying 100 shares for each period, you could spend more by purchasing high-priced shares and less when purchasing low-priced shares. The average stock price for this strategy is $12, opposed to the dollar cost average stock price, which is $9.54.

So, where does this big benefit of lower average stock prices come into play? If you look at the total amount you spend and the number of shares you purchase, dollar cost averaging gives you more shares for your portfolio at a lower cost. This is where you want your portfolio to be. This is also why investment gurus recommend dollar cost averaging for regular deposits to stock portfolios.

Now that you understand how dollar cost averaging works in comparison to buying a set number of shares for regular deposits, the next issue is whether dollar cost averaging works for irregular cash windfalls. You may be wondering if you should just invest your money in the market as soon as you can.

Lump Sum Investing: Understanding Your Risks and Rewards

Investing all your money at once or lump sum investing, is a noticeably different in the sense of variability and risk. Dollar cost averaging smooths out the average stock price and therefore lowers the risk. On the other hand, lump sum investing has a higher risk because you invest all your money at once. When comparing the rewards and risk, the lump sum investing technique brings higher returns, even after accounting for the higher amount of risk. This is due to the historical increase in stocks over time.

By investing all at once, instead of spreading out your stock purchases, you invest your money sooner and you can put it to work growing. Investing money sooner when stocks are rising gives higher returns.

Which Should You Choose: Dollar Cost Average Vs. Lump Sum Investing

This result may not bode well for risk averse investors who are not sure about dropping all their money in the market at one time. If you aren’t sure which type of investment strategy to choose, here’s how:

- Dollar Cost Average: If you think you’ll need your money within five years, use this approach. If you prefer a bit of a safety net and are willing to sacrifice some potential returns, then follow the dollar cost averaging plan.

- Lump Sum: Use lump sum investing with a longer time frame or if you are more risk averse.

Within five years it is possible that the market may not have time to recover from a significant drop, so dollar cost averaging helps your portfolio. Over the longer term, there has historically been enough time for the business cycle to sort itself out. The psychological component of investing and saving for financial independence is a powerful component. Trust your comfort level when saving and investing.

In Conclusion

To pull everything together, if you invest regularly, such as adding to your 401k or your investment accounts, then you should invest a fixed dollar amount instead of a fixed number of shares. If you experience a windfall of cash that you don’t need in the near future, go ahead and invest it. Forget about dollar cost averaging and take the risk. History has shown that the risk of lump sum investing is overcome by the benefits it provides when comparing to dollar cost averaging.

Additional References

https:// pressroom.vanguard.com/content/nonindexed/7.23.2012_Dollar-cost_Averaging.pdf

http:// www.jamesegrantcpapc.com/docs/lumpsumbeatsdollarcostaveragingjoffinancialplanningapril1993.pdf

http:// www.sigmainvesting.com/advanced-investing-topics/dollar-cost-averaging