I am a car lover through and through. The engineering, the design, the speed. All of it. However, I don’t own a sports car, and “fast” would not be how I describe my trips around town. Why? Because I have a true disdain for depreciating assets. I can’t stand knowing that something I own loses […]

Saving and Budgeting

How I got my Ph.D. for free

Every so often I have a truly gifted student in my class that comes to me to discuss getting their Ph.D. They are hesitant because of the lack of knowledge surrounding what a doctoral program is like, how long it takes, and what it costs. Graduate school has this scary connotation. It must be expensive […]

Tricking Yourself: The Case for a Big Tax Refund

Humans are not rational. Irrationality is the argument of behavioral finance, and the proof of this has been growing over the past two decades. Traditional finance theory is centered on rational humans participating in the markets. Rationality is a main driver of the efficient market hypothesis. From a personal finance standpoint though, the findings of […]

My Wife and I Still Get an Allowance: How we use credit cards

Credit cards are an important part of me and my wife’s budgeting process. We needed a way to budget individually and as a family. The problem was using one card or a joint credit card account. It was difficult to keep track of who was spending what and the feeling of guilt every time either […]

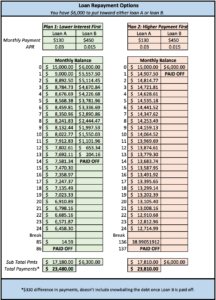

Paying Off Loans to Increase Cash Flow

Paying off debt with the highest interest rate first, then moving down the line to lower interest rates is common advice in the finance world. There is no question this plan will save you money in interest payments from a purely numeric standpoint. I even discuss this strategy in my cash windfall article. However, like […]

Savings Rate Calculations Simplified

Once you have embraced saving for financial independence, you can track your progress using a few simple savings calculations. When working through the following equations, the savings amount will be a combination of any money you add to savings, as well as any debt principal reduction. To be clear, this does not include total debt […]