There is no question the expense of college is more than most students can handle. With the average senior graduating college with $30,000 in student debt, it is impossible to ignore the importance of understanding the ins and outs of student loan debt.

An Introduction to Student Loans

Students are all faced with the decision to take out student loans for their education. The increase in wages from a college degree helps make this decision easy. However, the ease of receiving thousands of dollars can also be dangerous for those not comfortable with their finances. With the wide range of job markets and positions available for college graduates, it is important for students to understand what types of jobs and salaries will be available to them after they graduate.

If the job market is difficult or salaries are not that high, then the option to take out a student loan should be under heightened scrutiny. Taking on debt you will be unable to pay back in a reasonable time frame is a recipe for financial disaster. Students who find themselves in this position should consider other options to either make college less expensive or their incomes after college higher. Options include taking on a part time job while lengthening the time spent getting a degree to help some students lower the financial burden. Other students may benefit from switching majors to a degree with better job prospects.

The Revenge of the Nerds: Good Vs. Bad Debt

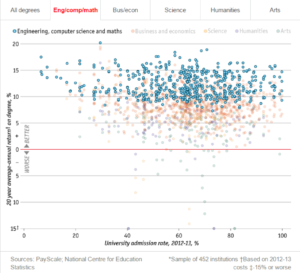

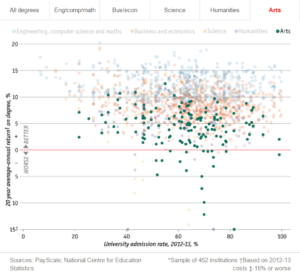

An article in the Economist, “Revenge of the Nerds”, shows the different returns on the education investment. These graphs shown plot different degrees based on admission rate and the annual return graduates receive with this degree. The results, while not surprising, are informative. Light blue dots denoting engineering, computer science, and math show the highest return on investment, even though the admission rates range from around 10 to almost 100 percent admission. Art degrees do not fare as well, showing low and sometimes negative returns.

The debate on whether to take on student loan debt usually boils down to the question of what defines good or bad debt. On one hand, choosing a degree that will give you a higher income means you could get a higher return on your debt investment. For example, if you borrow $25,000, you can make an additional $20,000 per year after graduating. While the positive return on investment is a good starting point in determining the difference between good and bad debt, the nominal amount of debt is another imposing factor.

The ease of collecting student loans can make students over extend themselves. They could end up leaving school with loans much higher than what would be acceptable or reasonable for their increase in salary. An example of this would be a total of $80,000 in loans for a job that earns only additional $10,000 per year.

Chart Source:Revenge of the Nerds, The Economist Data Team. 3/6/15 http://www.economist.com/blogs/graphicdetail/2015/03/daily-chart-2

Exploring the Student Loan Market

The student loan market creates its own controversy. The government charges interest on public student debt. This means, while it is easy for students to acquire loans, student loan debt isn’t an affordable option for education funding. Current interest rates on student loan debt can be as high as 6.8%. At that rate, a student with the average amount of $30,000 will pay roughly $2,000 per year in interest payments alone upon graduation.

Since this is only the interest amount, a graduate would have to pay more than $2,000 per year to begin chipping away at the actual $30,000 principal they owe. Worse yet, many students who take on this expensive debt are earning degrees in subject areas that have little to no job prospects. This only makes this problem more dangerous for students. In addition, student loans are difficult to forgive through bankruptcy. Keep reading to learn more about student loans and bankruptcy.

By offering federal loans, the government walks a fine line of allowing citizens to easily pursue a degree of their choice, but creates the risk of students making poor financial choices with this money like choosing a degree that offers no return. Instead these students face financial stress because of the difficulty in paying back the debt.

My Advice for Students

As a professor, I speak with students regularly who are following their dream, but following their dream down a pathway of high debt and low income. I give the same advice to all of them. Educate yourselves on all your opportunities when you graduate. If these prospects do not make you happy or are not going to pay for the lifestyle or bills you expect, then something must change. There is nothing wrong with lower income jobs if you are aware and comfortable with that income level.

Most students are surprised to learn they can blend their “dream” with a career that pays a higher salary. Artists may find that advertising, marketing, graphic design and computer programming all have an abstract and artistic feel. English majors can discover that quality writing is desirable in almost every discipline. However, coming out of school with a business degree and quality writing background will command a much higher salary than someone with an English degree who is working for a business.

In the rare case that there is no way to blend your career with your passion, decide whether your passion can be a hobby, instead. It could be something you can enjoy, but not work on 40 hours per week. Many people find when something they love becomes their career, it morphs into just being a job and it loses its luster, making the hobby option even more enticing.

While this article may bring you a sense of doom and gloom, this is not my goal. I wrote this to help students understand what they are getting into when acquiring student debt. I want to help graduates pay off their loans in an efficient and methodical way. For current students, the first step is to only take on loans than you absolutely need. Treat loans as a last resort.

Taking out a loan should not deter you from continuing your education, but it should put a slight sour taste in your mouth. Never become complacent with taking on debt. This is a dangerous habit and one that is difficult to break later in life.

Accrued interest and Grace Periods

Even though student loan payments are not required until six months after graduation, interest is accrued from the acceptance of the loan. This means your student loans are collecting interest and adding this interest amount to the original principal amount you owe, even though you are still in school.

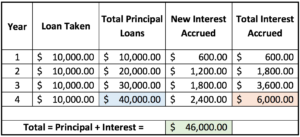

To put some math behind this explanation, let’s assume that you borrow $10,000 each year of your four-year education at a six-percent interest rate.

When you graduate you will owe more than $40,000. You will owe $40,000 in principal, which is the amount you borrowed and $6,000 in accrued interest.

You owe $600 every year in interest (6% x $10,000 = $600) for every $10,000 in debt you take on. While you are in school, you are not making these interest payments, but don’t worry, the government keeps a record of how much you missed. Before you can make any payments toward the $40,000 you borrowed, you have to pay back your accrued interest. This means that the first few years of payments after graduation could all be going to paying back interest while still maintaining the $40,000 in debt.

Grace Periods

Once you graduate, you have a “grace period” of six months before you are required to start making payments on student loans. Even though your payments are not required, just like being in school, interest still continues to accrue over the six months.

Principal Vs. Interest Payments

Interest is accrued on your loans every day you have a principal balance. When you make a payment, interest is paid first then anything left over goes toward your principal. If you owe $125 in interest every month and have $30,000 in loans, you must pay more than the $125 for your loan amount to decrease.

For example, with a $125 monthly interest payment, if you paid $125 every month, you will always have $30,000 in loans. In this case you are getting nowhere, you are just staying alive. If you decide to pay $200 this month, $125 goes to interest and $75 goes to principal. Then, the next month you will have $29,925 in loans and roughly $124.68 in interest. The only way you will ever pay off your loans is to pay back your principal, which means first fighting through the monthly interest payment.

Choosing Your Payback Plan

Once you have established the difference between interest and principal, you can choose a payment plan. When you graduate, you will have different payback options for your loans. No matter which option you choose, you can always pay back more than what is required, but not less.

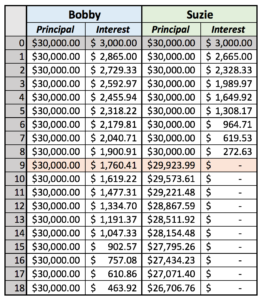

Look at the table below showing the difference between two payback options. Bobby and Suzie both have $30,000 in student loans when they graduate college at a six-percent interest rate. They both have $3,000 in accrued interest that has built up while they were in school. They must pay this accrued interest back before they can make any principal payments because interest always comes first.

Suzie chooses a plan that pays back her loans with a $500 payment every single month. Unlike Suzie, Bobby chooses a plan that requires him to make a payment of $300 per month. As a side note, these are realistic examples of what to expect. A $300 to $500 monthly payment is not at all uncommon.

As you can see in this example, Suzie is able to pay down her interest and then principal much faster than Bobby. Every month approximately $150 accrues in new interest expenses and they need to pay it off first. When Suzie makes her $500 payment, $150 of her payment goes to pay off new interest, while the remaining $350 goes toward her accrued interest balance, which would be converted to her principal at graduation. Since Bobby is only paying $300 every month, half goes to interest and only $150 goes to accrued interest. After 18 months, Bobby hasn’t even paid back his accrued interest, while Suzie has been decreasing the initial principal of her loans since month nine.

Snowball Payback: Choosing Specific Loans to Pay Off

One of the advantages you have if you take out multiple loans is the ability to choose which loans to pay off the principal on when you pay more than your required monthly payment.

For example, if your required payment is $240 and you pay $400, you can choose which loan gets the extra $160 towards the principal. If all loans have the same interest rate, there is no advantage to paying off one loan over another. However, if your loans have different interest rates, you should put excess money toward the highest interest rate loan.

By decreasing this loan, your interest expense will decrease little by little. See the example of how to “snowball” your loans. You put excess money to the highest interest rate loan. Then once you pay that loan off, you put all your excess money to the next highest interest rate loan. Over time, the amount you are paying toward loans increases because paying off past loans means less “required” payments are due.

If you started off with three loans and now you have one, you are putting the same amount of money you used to pay for three loans toward one. Like a snowball, this technique starts slow, but once the process gets rolling, the last loans are eliminated quite quickly.

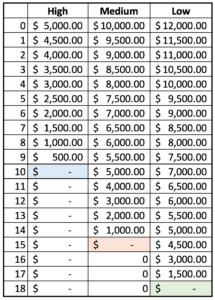

In this example, you have three loans of high, medium and low interest rates. For the sake of simplicity, don’t worry about any accruing interest, just the payment process. In the first year, you put $500 to each loan, decreasing the total amount owed by $1,500. Once you pay off your high interest debt, you can “snowball” this $500 to the next highest interest rate.

By year 11, you will use $1,000 for the medium interest rate debt and $500 for the low interest rate debt. Regardless of how many loans you have, this process will continue to pay off the higher interest loan first.

Understanding Your Payoff Number

If you are close to paying off your loans or have enough money in the bank to pay off your loans completely, you can request a payoff number from your loan servicer. Since interest is always accruing, the amount you owe on your loans changes every day. By requesting a payoff number, your servicer will give you a number that is good for a few days or even a week. If you pay this amount, your loans will be completely paid off.

When to Refinance Your Debt

Refinancing your student loans may make sense if you are paying high interest rates. Refinancing is just a fancy way of saying you are going to have a new bank pay off your student loans. In return you will owe this new bank your student loan balance, but at a lower interest rate. This will save you in interest expenses every month.

Refinancing has some important advantages. For one, by refinancing your loans at a lower interest rate, you will save on interest payments each year. The second advantage is consolidation. If you have many loans, especially if these loans are with different lenders, going through with the refinance will combine all these loans into one amount, with one lender, for one interest rate.

The question then becomes when should you refinance your debt or if do you even need to? The biggest consideration is whether the refinance rates will be lower than what you are currently paying and whether the difference is significant enough to go through the refinancing process.

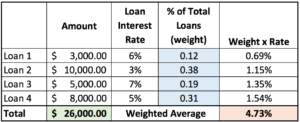

Determining Your Interest Rate for Refinancing

To determine your average interest rate, take the weighted average of your interest. To compute a weighted average, multiple the weight of each loan by the respective interest rate and add these numbers together. You can see this in the lower right-hand corner of the example table, below.

Once you have your interest rate, compare the rates of different refinancing lenders. If your rate is higher than those offered by refinancers, then going forward with refinancing will save you in interest expenses.

Compare your current weighted average interest rate to the rates of refinancers. How much lower are their rates? If you are currently paying 6% and refinancers can give you 5.5%, is the 0.5% change worth the process? Multiply the difference between what you are currently paying and what the refinancer is offering by your total loan amount. Remember, the percentage is a decimal.

Example: 0.005 x $30,000 = $150. In this example, you would save approximately $150 per year.

While the $150 savings sounds good, be sure to ask whether the refinancer charges a fee to refinance your loans. If the fee is more than your interest savings, then you shouldn’t proceed. Also, ask whether the refinancer allows you to pay off your loans at any time without penalty. It may be the case that in exchange for the lower interest rate, you will not be allowed to pay off your loans for 10 years or you will have to pay a penalty for early repayment. This restricts your ability to free yourself from your student loans, even if you have the money to do so.

Compare the costs and benefits of refinancing including your savings from a lower interest rate, your timeline for when you plan to pay off your loans, and the new refinancing policies like fees and early repayment. After taking these factors into consideration, if you determine that refinancing will help your situation, you should move forward and refinance your student loans.

Student Loan Interest Tax Deduction

The U.S. Government gives a tax deduction for student loan interest paid throughout the year. This is interest not principal repaid. If you do not make more than $80,000 or $160,000 for married couples, you can deduct up to $2,500 of your student loan interest payments off your taxes – these are numbers as of 2016 taxes. You can find more information on this page of the IRS website.

Student Loan Debt and Bankruptcy

In bankruptcy, it is difficult to get your student debt discharged. In other words, it is hard to eliminate the responsibility of paying back student debt. This is another reason why it is important to pay off student debt quickly and efficiently. If ever in the future you have to go into bankruptcy, you won’t have to gamble on whether or not you will still be required to pay back student loans, even after you’ve gone bankrupt.

Government Paying Off Your Debt

There are special circumstances where the government will pay off your student loan debt for you. These circumstances require you to do some sort of public service work and make on-time, regular payments to your student loans for 10 years. If you register and follow these requirements, then Uncle Sam will free you of your student loan debt. I won’t go into too much detail here as not everyone fits the requirements, but you can learn more about this Student Loan forgiveness process here.

Conclusion

Student loans can open educational opportunities to students that would not have otherwise been possible. Students can go through school without making payments and are given six months after they graduate to start paying back the debt they have accumulated. While student loans open many educational doors, they can also eliminate certain opportunities post-graduation due to the financial burden they introduce.

Students should be wary of taking on student loans, making this option a last resort, even though loans are easy to obtain. After graduation, graduates should work diligently to pay off loans, understanding the impact of accrued interest and varying interest rates. Smart decisions like paying over the required payment, snowballing loans, and even refinancing can help pay off loans faster, leading to more financial flexibility and less stress.