Here’s one of the most common financial fallacies that has somehow slithered its way into water cooler chats unsurprisingly pertains to taxes:

The Lie: When you get a raise, and move into a higher tax bracket, you make less because you are paying more in taxes.

The first time I heard this, I figured it was a one-off assumption by someone who didn’t have any experience paying taxes. However, after some recent conversations, I realized this thought process is not all that uncommon.

The root of this fallacy stems from the lack of knowledge on how U.S. tax brackets work. Tax brackets are progressive, meaning the more you make, the higher your tax rate. Most people understand this concept; however, the missing component of this explanation is that you are only taxed at your tax rate for the money you earn within this bracket.

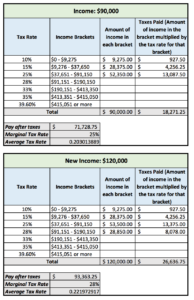

See this example for someone filing single who makes $90,000 and then gets a raise to $120,000 using the 2016 US tax brackets:

As you can see, there are two tax rates: a marginal rate and an average rate. The marginal rate is the tax bracket you “fall” into, and the average tax rate is the percentage you actually pay in taxes. Knowing the difference between the two tax rates is the key to understanding the tax fallacy people have been talking about is indeed, false.

While the second example shows a higher amount paid in taxes, the take home pay doesn’t go down and in fact, it still goes up along with the raise. If you get a raise and move into a higher tax bracket, your take home pay does not go down. You are only taxed a higher tax rate on the money you make in that tax bracket, not on your total income.

Now that you understand how taxes work, you can educate others who don’t. That way, everyone can look forward to getting their next pay raise. Be sure to explain the two types of rates, marginal and average, which is the basis for understanding the real tax truth.