Paying off debt with the highest interest rate first, then moving down the line to lower interest rates is common advice in the finance world. There is no question this plan will save you money in interest payments from a purely numeric standpoint. I even discuss this strategy in my cash windfall article. However, like many words of wisdom, there are exceptions.

One exception to the highest to lowest interest payment plan is to pay off lower interest loans first if doing so will increase your monthly cash flow. This cash flow increase comes from reducing the total of your monthly minimum loan payments. In this case, the benefits of having lower monthly expenses outweigh the interest savings benefits of paying off high-interest debt first.

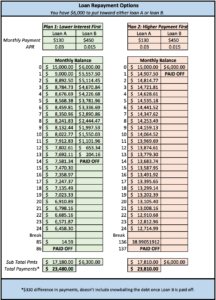

An Example and Its Accompanying Spreadsheet

Here’s an example:

- You have two loans, Loan A and Loan B.

- Loan A has an interest rate of three percent, a monthly payment of $130, and a balance of $15,000.

- Loan B has an interest rate of one and a half percent, a monthly payment of $450, and a balance of $6,000.

In this example, you have just received a cash windfall of $6,000 to allocate toward loan repayment. For the first option, you put the $6,000 toward the high-interest debt first. In the second option, you apply the cash toward the lower balance debt first.

By paying off the higher interest rate loan first, you will reduce the amount paid in interest over the life of both loans. But the required monthly payments are higher because the two loans are still outstanding. By paying off the lower interest rate and higher payment loan first, you gain other non-numeric benefits.

Because you pay off Loan B sooner, your monthly expenses decrease by $450. Lower monthly payments increase your financial flexibility by freeing up your cash flow. If you face a financial detour and lose income for a few months, you will only be required to make the minimum payment on Loan A since you have paid off Loan B. If you paid off high-interest debt first, you would still be required to make payments on both loans.

Your emergency fund will also be lower, which is your monthly expenses multiplied by three months (more details on emergency funds). Having extra money each month allows you to invest more or pay off other debt. So, you will pay $330 more in total payments by paying off the lower interest debt, but this doesn’t include all the other financial flexibility benefits.

Also, this example doesn’t consider your ability to snowball your debt payments. After you pay Loan B off, you can transfer the old $450 and apply it as an additional monthly payment to Loan A.

Remember, Not All Situations are the Same

The interest rates are low for both loans. Some investors would argue that you shouldn’t pay off either of these loans since historical investment returns are higher than the loan APRs. Although this advice may seem valid, I defer to the “not all situations are the same” response.

Some investors find a lot of value in the benefits of paying off all loans, not just high interest loans, such as financial flexibility, less stress, and a lower emergency fund. These perks may outweigh the monetary benefits of investing the cash and keeping these low-interest loans. Invest and save in a way that makes you feel comfortable. Use the monetary outcomes in this post and others as guidelines for you to make an informed decision related to your unique circumstances.

In general, you may want to consider a non-traditional payoff process if your loans meet certain criteria. The following two circumstances warrant a second look at whether the high-interest loans first dogma is in your best interest:

- Low-interest debt with a high required monthly payment or a high minimum payment, although these are sometimes different.

- Low-interest debt with a small balance remaining, but you don’t plan to pay it off for a long time.

What I hope you take away from this article is the lack of definite rules in achieving financial independence. While paying off high-interest debt first makes sense with quick calculations, you should also consider other factors like monthly cash flow, emergency funds, financial flexibility and emotional benefits. Overall, deciding which loans to attack first includes multiple levels of analysis, not a one-size-fits-all approach.