Debating on a Roth or traditional retirement plan is usually as involved as choosing a retirement account gets. But, last year I was thrown for a loop. I found out my employer offered the holy grail of retirement plans. The 457b deferred compensation plan. This plan isn’t anything like an IRA, 401k, or 403b. The 457b […]

retire early

Is Working Allowed in Early Retirement?

There is this belief that once retired you cannot do another day of work…forever. It would be blasphemy. You can’t be retired and have a side job, that would be too much for the extreme early retirement disciples to handle. I see people blasted on blogs and forums for taking a part-time job or starting […]

Your Number: How Much You Need to Retire

Many factors need to be taken into account when deciding how much you need to have saved for retirement. Solving for this number is a significant step on your path to retirement, and the task can be as complex or as simple as you want it to be. This post is lengthy but includes everything […]

Why Early Retirement?

Go to college, get a job, work for 42 years, retire, live for 13 years. That’s the path that has been laid out for us. That is the norm. But these are just numbers, not rules, but have unfortunately become the only path that people consider. A goal of early retirement is not a New Years […]

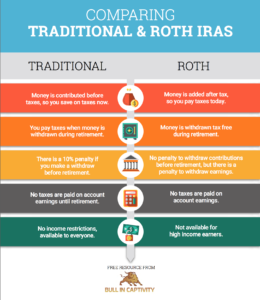

Quick Comparison of Traditional and Roth IRAs

Traditional IRA Money is contributed before taxes, so you save on taxes now. You pay taxes when money is withdrawn during retirement. There is a 10% penalty if you make a withdraw before retirement. No taxes are paid on account earnings until retirement. No income restrictions, available to everyone. However, tax deduction is limited by […]

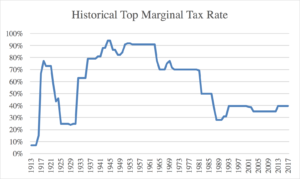

Gambling on Future Tax Rates

I’ve been doing the annual review of my 403B, which is like a 401K, but for public employees. Since we are shooting for early retirement, my contributions go into a Roth account. This allows the Mrs. and I to pull money out of the account before 65 without any penalty or tax since the contributions […]