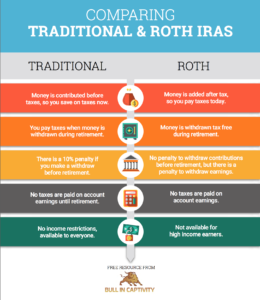

Traditional IRA

- Money is contributed before taxes, so you save on taxes now.

- You pay taxes when money is withdrawn during retirement.

- There is a 10% penalty if you make a withdraw before retirement.

- No taxes are paid on account earnings until retirement.

- No income restrictions, available to everyone. However, tax deduction is limited by income.

Roth IRA

- Money is added after tax, so you pay taxes today.

- Money is withdrawn tax free during retirement

- No penalty to withdraw contributions before retirement. There is a penalty to withdraw earnings before retirement.

- No taxes paid on account earnings

- Not available to high income earners

Please ask permission before sharing or modifying this infographic.