Many Americans rely on professionals for financial advice, but like any type of service, there is a potential for conflict. Financial advice is a hotbed for potential agency problems. The reason someone seeks advice from a financial advisor is that they are not comfortable making financial decisions without guidance. Assuming these individuals do not have […]

Archives for October 2017

10 Crazy Finance Facts

If you start with one penny and double your money every day for one month, by the end of the month you’ll have $10,737,418. 79% of US stock trades are made by computers and electronic trading. Due to hyperinflation in 2009, Zimbabwe started printing 100 trillion dollar bills. Equivalent to only $0.40 when it was […]

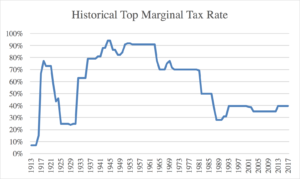

Gambling on Future Tax Rates

I’ve been doing the annual review of my 403B, which is like a 401K, but for public employees. Since we are shooting for early retirement, my contributions go into a Roth account. This allows the Mrs. and I to pull money out of the account before 65 without any penalty or tax since the contributions […]

Why I’m Hooked on Audiobooks – and You Should Be, Too

I listened to my first audiobook last year. I didn’t know how I would feel about not turning the pages myself or having someone read to me. This isn’t elementary school. I thought I’d start with an easier “read,” something more enjoyable and less technical. The risk of falling asleep was already high, I didn’t […]

Savings Rate Calculations Simplified

Once you have embraced saving for financial independence, you can track your progress using a few simple savings calculations. When working through the following equations, the savings amount will be a combination of any money you add to savings, as well as any debt principal reduction. To be clear, this does not include total debt […]

How Early Retirement Changes Your Investment Options

It is easy to get excited about the path to early retirement, but sometimes when people get caught up in the excitement, they forget some basic investing principles. Misunderstandings of risk and timelines run rampant throughout the internet. Comments like, “I’m young and going to retire early so I am going to invest 100 percent […]